We recently significantly increased interest rates on consumer loans. From time to time we have loans whose credit risk rating seems strange to some investors and raises questions.

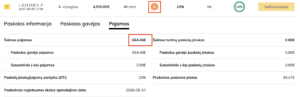

Investor Viktoras shared a recently issued loan and had a question why a borrower earning 664 EUR has an A credit score?

I would like to share a comment from Operations Manager Monika.

Why credit score A?

How important is income?

Income is one of the components of the credit risk rating. In order to assess the client’s ability to repay the loan, we evaluate the relative amounts.

In this case, low 20% ratio of debt to income (DTI) has a positive impact on credit score. This means that the borrower will allocate one-fifth of his income to all his obligations.

Work experience

The most important single criteria for assessing the client’s stability is the length of work at the workplace. Accumulated work experience lead to greater financial stability.

The recipient of this loan has been working at the same workplace for more than five years – 65 months.

Customer’s discipline

Our returning customers are 37% less likely to be late for more than 90 days. The better we know the borrower, the more accurately we estimate the probability of repaying the loan on time.

This customer is borrowing on our platform for the third time and has paid 35 out of 37 instalments on time since 2020.