Secondary market activity has increased in July – 8% more deals were made compared to June – 3051. Total turnover in July was more than a third higher than a month before – 74.293 Eur.

We continue secondary market strategy articles cycle. We will release new post once a month.

Secondary market strategy: constantly late

How to earn few months’ interest in a few days?

Some borrowers make monthly payments late, but almost on the same day.

By buying a late loan with a discount after the borrower pays the instalment, you will not only receive interest and late fees, but also the opportunity to sell the current loan at par price and profit the discount.

Cons of strategy

1. The risk that the borrower will not pay the instalment and you will not be able to earn interest in a very short period of time;

2. Liquidity risk – there may not be a buyer who wants to buy the loan.

3. Time-consuming activity – in order to check the loan schedules, you will need to spend some time.

How to manage risk?

When looking for a loan, it is worth paying attention to two things:

1. Does the borrower make payments at a similar time each month? – increasing gap between payments increases risk.

2. How long have the payments been made on a given day? – the longer the payment history, the higher the probability that the regularity of payment of instalments will remain unchanged.

Case study

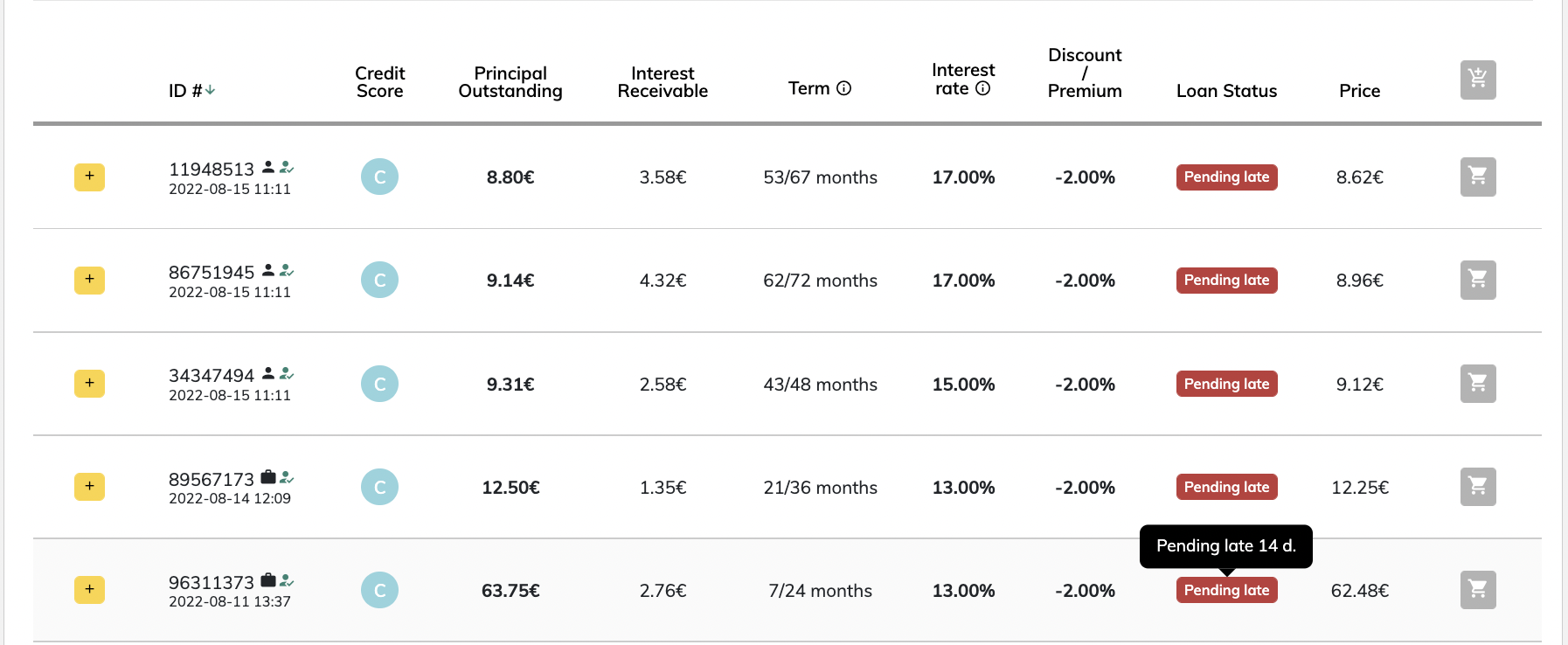

- We are looking for a loan with a discount of at least 2% (or any other number you want) with a delay of up to 30 days.

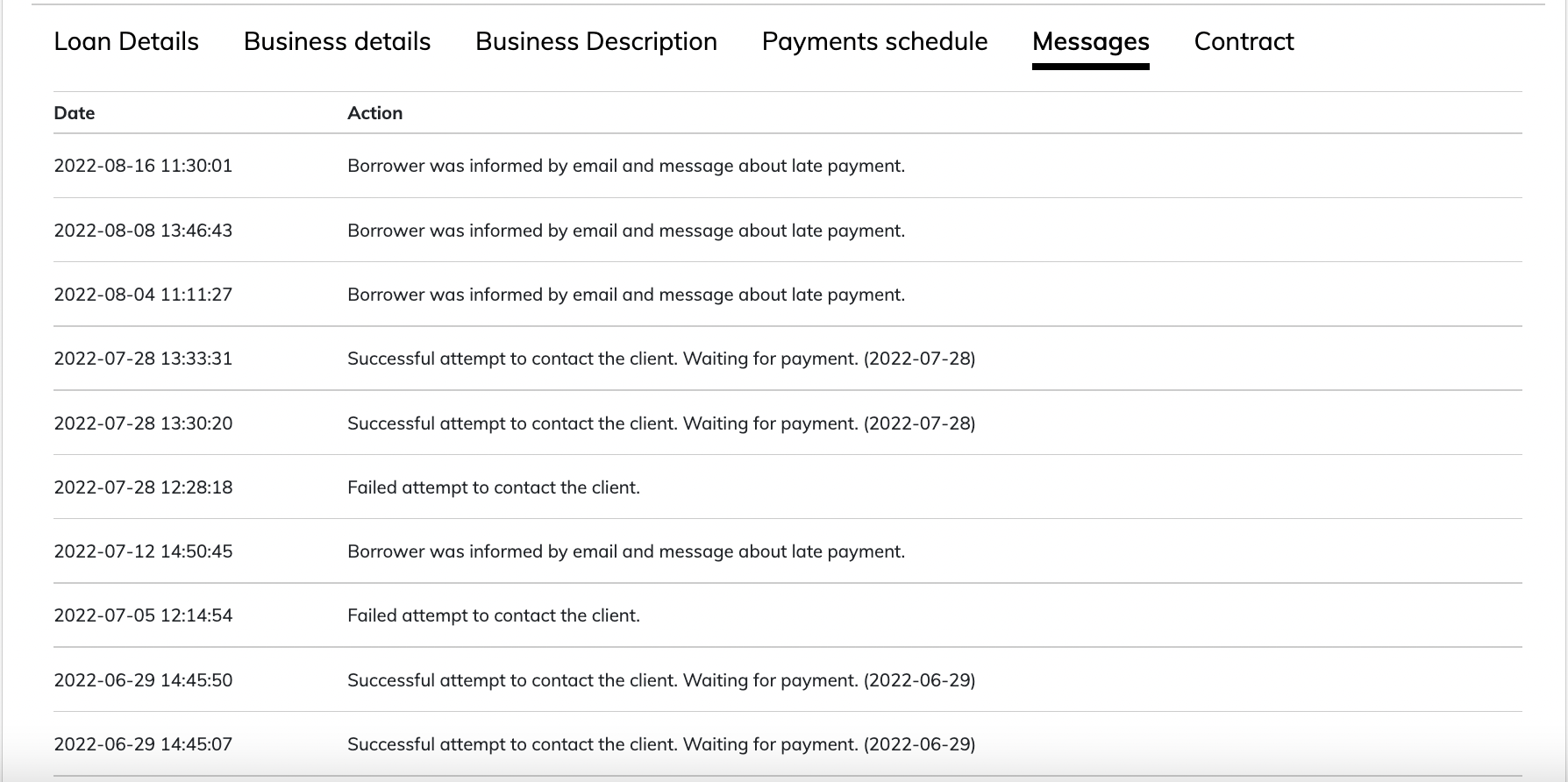

- We check the situation with the borrower by clicking on “Messages”. If the borrower makes payments at the same time every month (in the example on the 28th – 29th) and the day of late payment has not yet come this month (today is the 16th), then this loan may be of interest to us.

- This borrower has been making one payment each month since February. This information is not currently displayed in the loan schedule on the platform. The status of the borrower remains to be determined based on the messages of our collection team and the status of the payment in the paid loan schedule.Soon we will update the display of late payments and the loan schedule will display the date when the payment was fully paid, so it will be easier to follow this strategy.

Simas.