Hello,

there are two inevitable things in life – taxes and death. I would like to share our experience and results in collecting loans from deceased borrowers.

What happens when the borrower dies?

First of all, I would like to share my experience about the situation when the borrower is no longer alive.

I had this experience for the first time in the first year of my work in the platform five years ago. We gave a loan to a company, and after a few months the company’s payments were late. When trying to contact the sole employee and shareholder of the company, it was not possible to do so, no one answered the calls.

One evening already after working hours, I received a call from the number of the aforementioned company. A relative of the shareholder called to inform that the borrower had brain surgery and asked not to call again. I was in a bit of a shock because it seemed that until recently I was talking to someone about her business, and now the situation is completely different.

We are responsible for the safety of investors’ money and we have no possibility to stop the recovery process, we handed over the company to the bailiffs.

About a year after the call, the bailiff executing the collection announced that he was suspending the collection and returning the executive document because the company was liquidated and had no assets, the guarantor was deceased and she also left no assets.

How do we ensure the safety of invested money?

Prevention

The creditor’s claim must be filed within three months from the date of inheritance, i.e. death of the debtor. Failure to do so – in most cases the debt is written off by court decision.

According to the Consumer Credit Law, we can terminate the consumer loan agreement no earlier than after 90 days, so if the relatives do not inform about the fact of death, there is a 30-day window, when it is theoretically possible to miss the 90-day period. We manage this risk by checking the borrower’s status in the Registry Center after 60 days of delay.

Recovery process

If it turns out that the debtor has died, we check the Register of Wills:

1. If the acceptance of the inheritance is registered – we immediately contact the heirs with a creditor’s claim about the concluded loan agreement.

2. If the acceptance of inheritance is not registered – we immediately contact the notary with a request to add us to the list of creditors of the borrower and inform the heirs.

If it is not possible to identify the heirs, during the first year after the death of the borrower, we periodically check whether the inheritance has been accepted/rejected and monitor whether the inheritance has not been accepted by the state.

When does a debt become bad?

The debt is written off in three cases:

1. For one year, no heirs have been identified, there is no data on inheritance in the Register of Wills, the borrower has no real estate according to the Real Estate Register.

2. If the bailiff, based on the material in the file, makes a decision to end the case with an act of impossibility of recovery and returns the executive document, because the debtor is deceased and there are no assets from which recovery can be carried out.

3. When the property is inherited by the state, or the inheritance is accepted according to the description of the property, and after selling the inherited property there are not enough funds to cover the entire debt, the balance of the unpaid debt can be recognized as a bad debt and written off.

Recovery results from deceased persons

Currently, we have 8 fully repaid loans of deceased persons, 6 loans are being paid by the heirs, 17 loans are hopeless, and we are waiting for another 15 loans until the heirs appear.

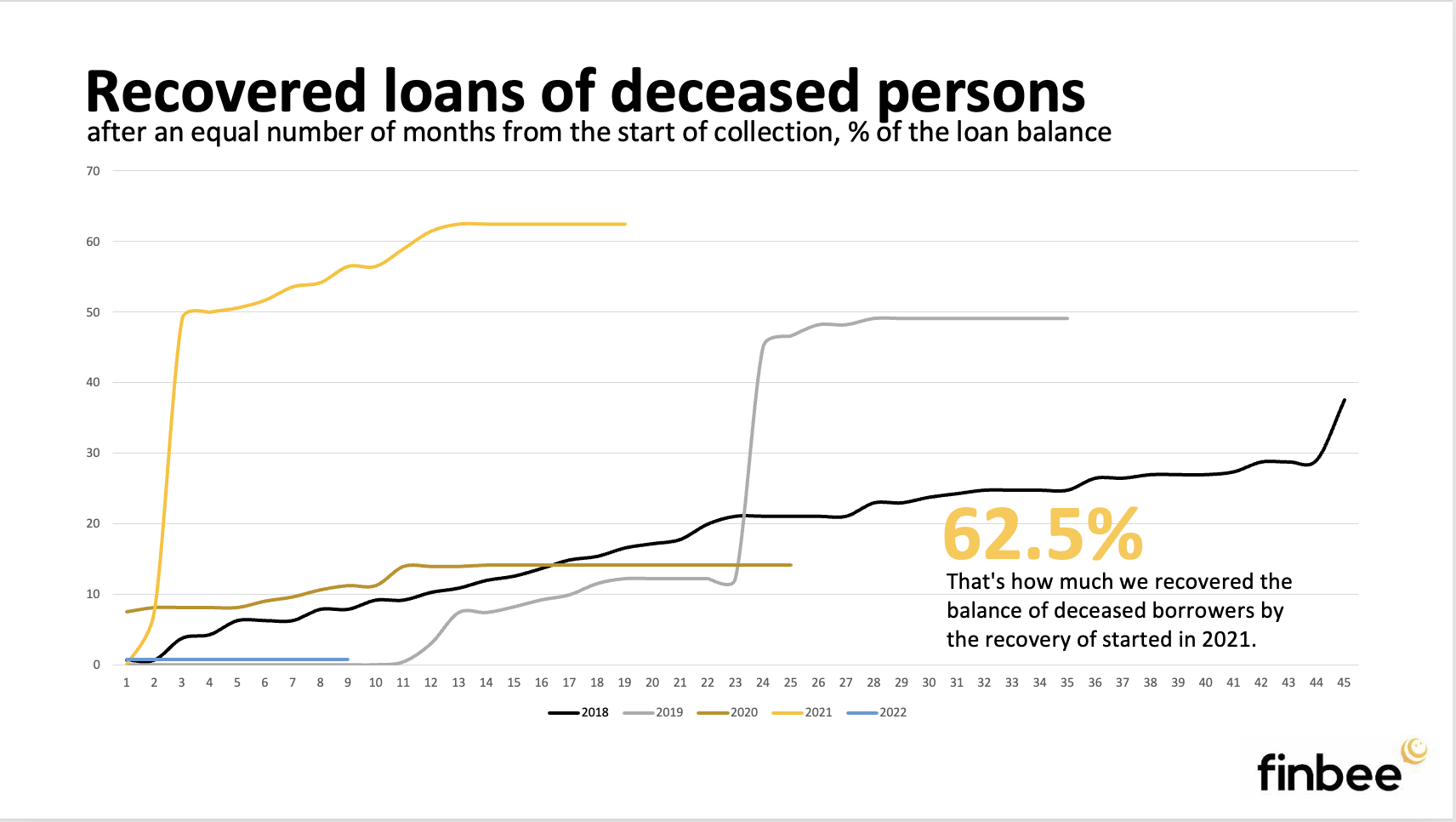

I share the results of the recovery of loans of deceased persons who have become insolvent.

Simas.